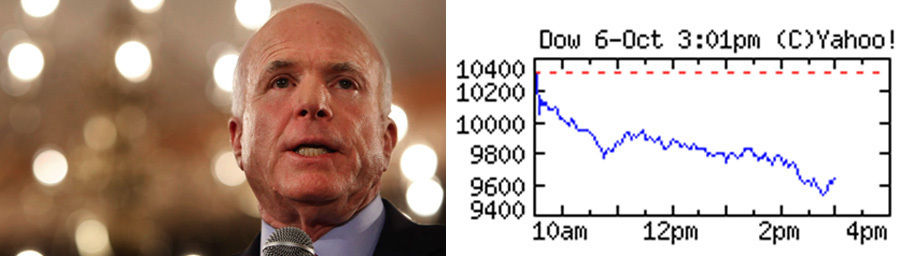

The stock market fell 800 points by 3pm today before closing down 369.88. Meanwhile, John McCain's campaign admits that if they don't change the subject from the economy to something else, "...We are going to lose." Instead of providing a plan or answers, the campaign instead wants to "turn the page."

The stock market fell 800 points by 3pm today before closing down 369.88. Meanwhile, John McCain's campaign admits that if they don't change the subject from the economy to something else, "...We are going to lose." Instead of providing a plan or answers, the campaign instead wants to "turn the page."ORIGINAL POST, 1:47PM:

Today, the stock market crashed by over 700 points for the 3rd time since the US Banking & Credit Crisis of 2008 in a signal that global markets really aren't impressed with the recent bailout (read: rescue) bills passed by the US Senate and House of Representatives. The NY Times article "Credit Crisis Drives Stocks Down Sharply" is excerpted below:

Stocks took an even sharper dive late in the afternoon on Monday, as stricken investors sent the Dow Jones industrials down more than 700 points with 90 minutes remaining in the session.Markets around the world spiraled downward on Monday as the banking crisis tightened its grip on the global economy. For the first time since 2004, the Dow was trading below 10,000, a psychological milestone that came as the index lost more than 500 points in the first hour of trading alone.

Selling intensified throughout the morning as investors reeled from a series of high-profile bank bailouts in Europe, where governments scrambled over the weekend to save several major lenders from collapse.

By 2:30 p.m., the Dow was down 6.9 percent. The broader American stock market fell 7.5 percent, as measured by the Standard & Poor’s 500-stock index, its worst decline since last Monday’s 8.8 percent drop.

The Dow has lost more than 1,100 points — or about 10 percent — in slightly more than a week. The S. & P. has lost more than 15 percent in the same period.

The sharp slides came despite more reassurances from President Bush and a morning announcement from the Federal Reserve that it would significantly expand the amount of money it made available to major banks. The Fed will now lend up to $900 billion in credit, an enormous sum that officials hope will reassure banks that the government will provide them with adequate capital.

The moves were aimed at resolving a problem at the center of the current credit crisis: the reluctance of banks to lend. The healthy functioning of the world’s economy is dependent on the easy flow of short-term loans among banks, businesses and consumers, a stream that has been cut off as banks become more fearful of giving out cash.

Despite a $700 billion bailout package passed by Congress last week, events over the weekend in Europe only intensified investors’ anxieties. European stocks fell by the biggest amounts in decades. Major indexes in London and Frankfurt lost more than 7 percent; stocks in Paris fell by 9 percent.

On Wall Street, energy stocks fared the worst after oil prices dropped below $90 a barrel, reaching their lowest levels since February. Crude oil was trading just over $89 a barrel in New York after 2 p.m.

No comments:

Post a Comment